| |

FAQs

|

General

|

| Q1: When can I start to offer units in a scheme after submitting a notification on CISNet? |

| Q2: When is the List of Restricted Schemes updated? |

| Q3: If the manager of the scheme is not

licensed, can he still offer units of the scheme? |

| Q4: What do the various statuses at the top

of the scheme’s homepage mean? |

| Q5: What is the purpose of the password

that is to be created at the end of the notification form? |

| Q6: How is the password different from

the access code, created by an agent? |

| Q7: What happens if I forget the password

for my fund? |

| Q8: What should I do if my scheme is locked? |

| Q9: What is the web browser compatibility

requirements for CISNet? |

Submitting notifications

|

| Q10: Who does the term “Responsible Person” refer to? |

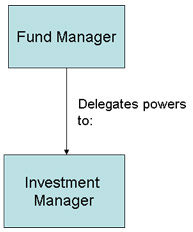

| Q11: If the fund manager has delegated its

discretionary investment powers to an investment manager (as per the structure in the figure 1 below), whose details should be provided

under the various sections? |

| Q12: Who should sign off on the declaration

for the notification forms? |

| Q13: If a scheme is a self-managed

corporation, whom should I indicate as the “manager”? |

| Q14: What is the purpose of the

“optional email address” field in the form? |

| Q15: Can I change the optional email address? |

|

Q16: What does the term "Amount of funds offered in Singapore" in the CISNet Form refer to?

|

|

Q17: How often do I need to update the figures for "Total fund size of the scheme" and "Amount of funds offered in Singapore"?

|

|

Q18: What are the disclosure requirements for an information memorandum?

|

|

Q19: Apart from a scheme's information memorandum, do I need to submit other marketing materials such as factsheets?

|

|

Q20: How often do I need to update the information memorandum submitted to MAS?

|

|

Q21: There is already an existing offering document or prospectus for the scheme.

Can this document be used to meet the requirement for an information memorandum to be provided to investors and submitted to MAS? In the event that this document does not contain all of the information required, will it be possible to include the outstanding information in an addendum to the document?

|

| Q22: Is there a quick way to submit

notifications for more than one scheme? |

| Q23: The notification for a scheme was first submitted by the DirRP. Can the DirRP

subsequently appoint an agent to make CISNet submissions (e.g. amendments to the notification form) on the DirRP’s behalf? |

Making Payments

|

| Q24: What are the fees payable for

restricted Singapore/foreign schemes? |

| Q25: I submitted payment but did not see

the payment confirmation page. What should I do? |

| Q26: I submitted payment in error/excess.

Can I request for a refund? |

| Q27: Can payment be made by methods other

than Visa, Mastercard and Amex? |

| Q28: Can payment be made for multiple

notifications at the same time? |

Annual declarations

|

| Q29: How does the procedure for annual

declarations work? |

| Q30: How do I complete an annual declaration? |

| Q31: How can I change the annual

declaration deadline? |

| Q32: Can I amend information on the scheme

while I am making an annual declaration? |

| |

^ back to top |

|

Q1: When can I start to offer units in a scheme after submitting a notification on CISNet?

|

|

A: You may only start making an offer of a scheme after receiving an email confirming that the scheme has been entered into the

List of Restricted Schemes. You should receive this email within 2 Singapore business days after the submission of the notification if the scheme satisfies the requirements under the Sixth Schedule to the

Securities and Futures (Offers of Investments) (Collective Investment Schemes) Regulations 2005 (SFR) and the payment for the scheme is successful.

For a scheme that does not invest in capital market products and is only offered to relevant persons as defined in section 305 of the

Securities and Futures Act (SFA), as the scheme will not be entered into the List of Restricted Schemes, you may start offering such a scheme after receiving an email confirming

that the payment for the scheme is successful. You should receive this email within 2 Singapore business days after the submission of the notification.

|

|

Q2: When is the List of Restricted Schemes updated?

|

|

A: The copy of the List on the MAS website is updated once every day, on or around 3pm(Singapore Time).

Thus, any notifications completed during the day which add, remove or change the information reflected on the List will only take

effect after 3pm.

|

|

Q3: If the manager of the scheme is not licensed, can he still offer units of the scheme?

|

|

A: Yes, if the manager is either:

(I) delegating its discretionary investment powers to another management entity, which:

(a) is licensed in the jurisdiction of its principal place of business; and

(b) is responsible for managing the property of the scheme; and

(c) makes the investment decisions or makes recommendations that are invariably followed by the manager; and/or

(II) managing a scheme that does not invest in capital market products and is only offered to relevant persons as defined in section 305 of the SFA.

|

|

Q4: What do the various statuses at the top of the scheme’s homepage mean?

|

|

A: Please refer to the following table:

| Status |

Explanation |

| Active |

These are schemes whose notifications have been accepted by MAS. They may be offered to relevant persons as defined in section 305 of the SFA and/or investors

who acquire units in a scheme at a consideration of not less than S$200,000 (or its equivalent in a foreign currency) for each transaction.

|

| Active Issues |

These are schemes whose notifications have been accepted by MAS but as a consequence of some changes to the particulars in the

notification, MAS is reviewing the notification. These schemes may continue to be offered to relevant persons as defined in

section 305 of the SFA and/or investors who acquire units in a scheme at a consideration of not less than S$200,000 (or its equivalent in a foreign currency) for each transaction.

|

| Issues |

MAS requires clarification on the information provided in the notification for these

schemes. As the schemes have not been entered into the List of Restricted Schemes, these schemes may not be offered to investors.

|

| Non-Public |

These are schemes that do not invest in capital market products and whose notifications have been received by MAS. They may be offered to relevant persons as defined in section 305 of the SFA.

|

| Terminated |

These schemes have been removed from the List of Restricted Schemes upon your notification that the

offers have been terminated or the schemes have wound up. These schemes may not be offered to investors. |

|

^ back to top |

|

Q5: What is the purpose of the password that is to be created at the

end of the notification form?

|

|

A: The password is needed for future access to the CISNet notification in respect of the scheme. The password

has to be created by the DirRP or his agent, if he has appointed one to act on his behalf.

|

|

Q6: How is the password different from the access code, created by an agent?

|

|

A: For IT security reasons, CISNet disallows the sharing of passwords. If the DirRP has appointed an

agent, CISNet will prompt the agent to create an “access code” which is to be communicated to the DirRP outside the

CISNet system. The access code is an identification tool to ensure that only the DirRP can launch the weblink embedded in the endorsement emails.

|

|

Q7: What happens if I forget the password for my fund?

|

|

A: You may reset the password by clicking on the ‘Forgot Password’ link on the CISNet homepage. You will be

asked to enter a new password. For verification purposes, an OTP will be sent to you at your registered email address after the password reset request submission. If the OTP verification is successful, your password will be automatically changed to the new password that you have provided and a confirmation email on the successful password reset will be sent to you.

|

|

Q8: What should I do if my scheme is locked?

|

|

A: Your scheme will be locked if you have made 3 consecutive invalid login attempts. Your scheme should be automatically unlocked after 3 hours of inactivity. You should not attempt to log in to the scheme during this period. Otherwise, you will have to wait for another 3 hours from your new login attempt for your scheme to be unlocked.

|

|

Q9: What is the web browser compatibility requirements for CISNet?

|

|

A: The browsers listed below have been tested for use with CISNet on the Web.

• Microsoft browsers: Internet Explorer 11+

• Mozilla Firefox browsers: Mozilla Firefox 47+

• Google chrome browsers: Google Chrome 49+

In addition, you will need to enable the following settings in your web browser for CISNet to function properly:

• Enable JavaScript

• Enable browser Cookies

• Enable Popups

• Enable SSL

|

^ back to top |

|

Q10: Who does the term “Responsible Person” refer to?

|

|

A: The term “Responsible Person” refers to the party who is ultimately responsible for the scheme. The term is defined in the

Securities and Futures Act as:

(a) In the case of a scheme which is constituted as a corporation, the corporation; or

(b) In the case of a scheme which is not constituted as a corporation, the manager for the scheme.

|

|

Q11: If the fund manager has delegated its discretionary investment powers to an investment manager (as per the structure in

the figure 1 below), whose details should be provided under the various sections?

|

|

Figure 1

A: Please refer to the following table:

| Section |

Party that details relate to |

| Contact details for “Information on the Manager” |

Fund Manager |

| “Disciplinary and Financial Record” |

Manager and Investment Manager. So to each question, the answer for both the Manager and

Investment Manager must be “No” if the “No” answer is to be selected. If the answer for the Manager is e.g.

“No” and that for the Investment Manager is “Yes”, then you should select “Yes” for the answer. |

| Contact details for “Declaration” |

Fund Manager |

|

^ back to top |

|

Q12: Who should sign off on the declaration for the notification forms?

|

|

A: The Director of the Fund Manager (as in figure 1 above) or the person who is authorised in writing by the Director of the

Fund Manager should sign off on the form.

|

|

Q13: If a scheme is a self-managed corporation, who should I indicate as the “manager”?

|

|

A: The manager is the Board of Directors of the corporation.

|

|

Q14: What is the purpose of the “optional email address” field in the form?

|

|

A: This field allows the Director of the Responsible Person (DirRP) to include the email address of another person

(e.g. secretary, compliance officer) whom he wishes to be kept copied on all email alerts from CISNet. The One-Time Password and endorsement emails,

where applicable, would not be sent to the optional email address.

|

|

Q15: Can I change the optional email address?

|

|

A: Yes. You can change the optional email address by submitting an amendment notification.

|

|

Q16: What does the term "Amount of funds offered in Singapore" in the CISNet Form refer to?

|

|

A: The term "Amount of funds offered in Singapore" refers to a restricted scheme's assets under management (AUM) which are attributable to units subscribed in Singapore.

|

|

Q17: How often do I need to update the figures for "Total fund size of the scheme" and "Amount of funds offered in Singapore"?

|

|

A: The figures for "Total fund size of the scheme" and "Amount of funds offered in Singapore" should be updated at each annual declaration. To do this, you will need to first submit an amendment notification to update the relevant figures before submitting the annual declaration. This process has to be repeated for each subsequent annual declaration.

|

|

Q18: What are the disclosure requirements for an information memorandum?

|

|

A: The information memorandum must contain the information required under Paragraph 1(2) of the Sixth Schedule to the SFR.

|

|

Q19: Apart from a scheme's information memorandum, do I need to submit other marketing materials such as factsheets?

|

|

A: Under Section 305(5) of the Securities and Futures Act (Cap.289), an information memorandum is defined as a document that (i) describes the units in a scheme being offered and (ii) has been prepared for delivery to and review by the investors to whom an offer of the units in the scheme is to be made so as to assist them in making an investment decision. Marketing materials (including factsheets) that are provided to investors in connection with the offer of the units in a scheme would therefore fall within the definition of "information memorandum" and have to be submitted to MAS together with the scheme's information memorandum (in one single PDF document).

|

^ back to top |

|

Q20: How often do I need to update the information memorandum submitted to MAS?

|

|

A: The information memorandum should be submitted for new notifications. Thereafter, you will only need to re-submit an updated information memorandum (including factsheets and other marketing materials) at the time of subsequent annual declarations if there are changes to the information memorandum (including factsheets and other marketing materials) submitted in the previous notification or annual declaration. If there are no changes to the information memorandum previously submitted, you need not re-submit the information memorandum.

|

|

Q21: There is already an existing offering document or prospectus for the scheme. Can this document be used to meet the requirement for an information memorandum to be provided to investors and submitted to MAS? In the event that this document does not contain all of the information required, will it be possible to include the outstanding information in an addendum to the document?

|

|

A: You may use an existing offering document for the scheme provided the document contains the information set out in Paragraph 1(2) of the Sixth Schedule to the SFR. In this regard, a foreign prospectus can be used if it (either on its own, or together with a Singapore "wrapper") contains all the information required under Paragraph 1(2) of the Sixth Schedule to the SFR.

|

|

Q22: Is there a quick way to submit notifications for more than one scheme?

|

|

A: Yes. After completing the payment process for the first notification, please click on “submit new

notification”. Parts of the form will be pre-filled using information from the previous scheme submitted.

|

|

Q23: The notification for a scheme was first submitted by the DirRP. Can the DirRP subsequently appoint an agent to make CISNet submissions (e.g amendments to the notifications form) on the DirRP’s behalf?

|

|

A: Yes. The DirRP can amend the scheme's notification form to include details of the appointed agent.

Once the agent’s details is added into the scheme’s notification form, the DirRP will no longer be able to submit notifications without the agent’s assistance.

|

|

Q24: What are the fees payable for restricted Singapore/foreign schemes?

|

|

A: The fees payable varies depending on the type of notification. Please refer to the table below:

Fees payable

| Type of notification |

Fee |

| New notification |

$250 |

| Annual declaration notification |

$50 |

|

^ back to top |

|

Q25: I submitted payment but did not see the payment confirmation page. What should I do?

|

|

A: Your payment may or may not have reached our payment services provider. Please wait 2 business days to allow the system to

process your payment and send you a confirmation email. If you do not receive any email after 2 business days, please access your

scheme's homepage on CISNet to make another payment.

|

|

Q26: I submitted payment in error/excess. Can I request for a refund?

|

|

A: There is no refund for payments for notifications that are submitted in error. You are advised to check your notification forms carefully before submitting them.

If you have made a payment in excess, you will receive an email to inform you of the duplicate payment.

Please reply to that email to confirm that you have indeed made a duplicate payment.

The refund will be paid to the credit card used for the duplicate payment.

|

|

Q27: Can payment be made by methods other than Visa, Mastercard and Amex?

|

|

A: No, the system currently only supports payments made using Visa, Mastercard and Amex.

|

|

Q28: Can payment be made for multiple notifications at the same time?

|

|

A: No, as the system is designed for straight-through processing of notifications, you will have to make

individual payments for each transaction so that payments can be properly matched to their respective notifications.

|

|

Q29: How does the procedure for annual declarations work?

|

|

A: You may only make an annual declaration during a one-month period before the annual declaration deadline. The next

annual declaration deadline will be one year from the annual declaration deadline, and not one year from the date you made the annual

declaration. {See chart below}

|

^ back to top |

|

Q30: How do I complete an annual declaration?

|

|

A: There are three steps for completing an annual declaration on CISNet:

1. Step 1: Submit an amendment notification to update scheme’s information. You will need to ensure that the AUM information of the scheme (i.e. the total

fund size of the scheme and the amount of funds offered in Singapore) is not more than 3 months from the date of the annual declaration. Please note

that this step may only be performed by the DirRP (or an agent in the case where an agent has been appointed for the scheme). A declaration that is

submitted by an agent has to be endorsed by the DiRP (or the POA of the DiRP, if applicable).

2. Step 2: Once the scheme information has been updated, you may submit an annual declaration through the scheme’s homepage on CISNet.

3. Step 3: To complete the annual declaration process, make a payment of S$50 by clicking on the payment tab on the scheme’s homepage on CISNet.

You will receive an email confirming that the annual declaration is completed after the payment is confirmed.

|

|

Q31: How can I change the annual declaration deadline?

|

|

A: You may change the annual declaration deadline by submitting an amendment notification via CISNet. The new deadline

chosen may be anytime earlier than the previous deadline, but no earlier than 14 days after the date of the amendment

notification. (See Chart below)

|

|

Q32: Can I amend information on the scheme while I am making an annual declaration?

|

|

A: No. You should update information on your scheme via an amendment notification before making the annual

declaration. The annual declaration process is intended only for the DirRP or the person who is authorised in writing by the DirRP (if applicable) to submit declarations

for the information that is provided in the scheme’s notification form.

|

^ back to top |

Last updated on 29 August 2021 |